If you want to convince yourself you can read a foreign language, try reading business articles. Well, let me clarify that: I’m not saying business English is a foreign language, I’m saying that business articles in another language you more or less know will prove surprisingly transparent.

I spent a recent flight back to the US in the company of a French edition of Harvard Business Review, bearing “Le must de l’Innovation” on its cover, and containing slightly abridged French versions of HBR articles by John Kotter, Gary Pisano, and even Francophones like Stefan Michel, who were perhaps seeing French translations of English translations of their original thoughts.

I must admit that this reading material failed in its primary mission – that of inducing sleep on the 8 hour flight to Detroit. Instead I was fascinated, not least by how the mental effort of translation served to disarm my critical faculties. Buzzwords that I would have pounced upon in English gained, in French, a certain elegance and plausibility.

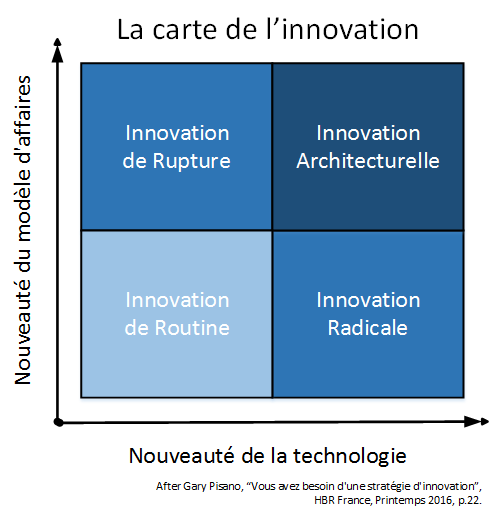

Let’s take, for example, the following diagram from Gary Pisano’s “Vous avez besoin d’une stratégie d’innovation”.1

In form, what could be more banal, more susceptible to pseudo-profundity, than yet another four quadrant diagram? (I speak from deep implication: we Buddhists have been foisting tetralemmas on a truth-thirsty public for over 2000 years now.) But language matters, too. Somehow “innovation de rupture” works for me in a way that more exhortations to be disruptive do not.

But I was struck not so much by how Pisano pictured innovation (I could easily group his non-routine quadrants into, say, “strategic innovation”), as what he said about innovation strategy:

La stratégie d’innovation d’une entreprise doit spécifier dans quelle mesure les différents types d’innovation sont adaptés à la stratégie commerciale et aux ressources devant être affectées à chacun d’eaux. Aujourd’hui, dans la majorité des articles consacrés à l’innovation, les innovations radicales, de rupture et architecturales sont considérées comme les moteurs de la croissance, tandis que l’innovation de routine est dénigrée et considérée comme une initiative relevant au mieux de l’aveuglement at au pire de suicide. Cette façon de penser est simpliste. Car the grande majorité des profits est générée par l’innovation de routine.2

In other words, strategic innovation gets most of the buzz, but routine innovation makes most of the money.

I read the above words with a pleasure of recognition, because it was immediately obvious (immediately, that is, once I had checked my reading against the English original) that Pisano has discovered an important new implication of what I have elsewhere called “Barson’s Law”. Indeed, it is only ignorance of Barson’s Law that has prevented Pisano from absolutizing his observation

So let’s help him out. With a little tweak we have – zut alors! – Barson’s Second Law of Strategy:

2: All profits are made by routine innovation.

From which two corollaries follow

1) The purpose of strategic integration is to clear the ground for routine innovation.

2) Routine innovation both defends against imitators and imitates disrupters.

What do I mean by all profits resulting from routine (i.e., product improvement style) innovation? I am referring not to life-cycle “return on investment” but to the current period balance sheet. Since I lack the skill to articulate this point in French, I will resort to an illustration. Let’s pretend that we are in possession of equations and a model to produce the following time-series graph:

In the above, we should not assume that the waves of investment and profit are on the same dollar scale or that all the time periods on the X-axis are the same. Profits, one hopes, will exceed its R&D investment by many magnitudes, and lucky is the firm that can shrink the “strategic” innovation period and lengthen the routine. This is because strategic innovation dollars, like those expended raising children, are dead cost, while routine innovation dollars are spent on products that represent actual revenue.

This implies that any business that is not a single-idea startup, needs a portfolio of products whose innovation requirements are distributed across strategic and routine innovation. This, of course, was the insight of the Boston Consulting Group’s Bruce Henderson, and indeed the BCG’s “Growth-Share Matrix” categories can easily be superimposed upon my innovation stage graph (though we will ignore their original four-quadrant diagram presentation):

It’s not my pretense to have precisely mapped my curves to BCG stages. I stand up, however, for its central intuitions: investment may be greatest at the “star” (established and growing revenue) stage, but profits are greatest at the “cash cow” stage – and still require considerable investment. Winners have to be extended and improved for as long as their revenue remains relatively stable and until that revenue can be replaced by new stars.

Returns on routine innovation are high but do decay under competition, which includes both imitation and parallel disruption. Ongoing routine innovation can refresh an existing product or business line, but it ultimately does so at a diminishing rate. The first improvements – those which capitalize on and reinforce growth – are the most transformative. Later improvements tend to be defensive and may even imitate parallel disruptions of competitors. Such activities can defend territory against marauders but lead to few new conquests.

Now, one might ask, does Pisano’s quadrant, or my second law, really add anything to the BCG matrix concept. Not if you collapse his non-routine panels into “strategic innovation”, as I have. At this level the insights are nearly equivalent and Barson’s Second Law devolves, perhaps, into the very practical and useful exhortation to “Read Bruce Henderson!”3 Pisano’s contribution lies in the typology I have ignored. It is crucial to know whether one’s innovative projects need to focus on business models, technologies, or both. But are such distinctions strategic? I would argue that the direction of innovation is driven by the nature of one’s inspiration or possibly, at a higher level, by the nature of one’s business. It’s important to know what business you are in. But that kind of knowledge seems to be more a prerequisite to a successful innovation strategy, than the thing itself.4

But whatever you decide “counts” as an innovation strategy, I think you have to concede that with his typology, Pisano gets it right – twice. He both establishes useful categories and reminds us, “il n’existe pas un type de l’innovation privilégie.” In truth, he doesn’t sound any better in French, but I sound smarter quoting him that way. That might be a third law.

—

1 For the English version, see Pisano, Gary P, “You Need an Innovation Strategy”, Harvard Business Review, June 2015.

2 In English:

“A company’s innovation strategy should specify how the different types of innovation fit into the business strategy and the resources that should be allocated to each. In much of the writing on innovation today, radical, disruptive, and architectural innovations are viewed as the keys to growth, and routine innovation is denigrated as myopic at best and suicidal at worst. That line of thinking is simplistic. In fact, the vast majority of profits are created through routine innovation.”

3 Or, better yet, to read BCG’s update of the Growth-Share Matrix. See Reeves, Moose, and Venema, “BCG Classics Revisited: The Growth Share Matrix”, June 4, 2014.

4 But one can certainly lead to the other. See Pisano’s excellent discussion of Corning’s long-term basic R&D approach in the article mentioned above.

Pingback: The Tomato was right on Innovation! Is that a Good Thing? | winter tomato